trading strategy based on litigation

I think researches on trading systems is the intense progeny of building trading strategies. Our main finish is to build a strategy, which will be successful in the future and not only connected backtests (curve-fitting). That is why I count it right to come out the topic with the description of the two approaches to the creation of trading strategies.

Two approaches for researching of trading systems: information mining and statistics vs market bodily structure research

Marketplace construction research

Understanding the essence of inefficiency, which underlies the system earnings. For conjecture, the basis of this can be expressed in Buffett's aphorism: "If you've been playing poker for half an hour and you still don't acknowledge who the patsy is, you're the patsy." If you fare not know who loses on the exchange, then you lose. You should know it when you trade. To earn money on a system, other traders must lose along this system. Again, trading is a zero-center game. Understanding the food market phenomenon is very variant from "dragging opinions onto the commercialise."

Foremost, we forge a hypothesis about the demeanour of unitary or another type of participant. Then we convey this surmisal in terms of price, volume, and then on. And only then we test this guess on history. If it "came together" exactly as we assumed, then the chances that this is just an accident are extremely low. in this way we produce concurrently both the "built-in" robustness and the "trigger", the public presentation of which allows United States to judge that the phenomenon has died.

For instance:

- There are some common behavioral patterns of mutual funds, for representative, a few days before the close of the month they trade off graceful stocks and in the primary two-three years of the beginning of the new month, they bargain them back. So, you can identify them and try to build Mean-Reversion trading strategies supported these price movements.

- In Brasil in 2022 at that place were frosts and the price of coffee was increased significantly. It was same a big coffee cultivate loss. Those who had entree to information connected the loudness of Brazilian coffee for export in export certificates saw that the volumes prepared for exportation did not fall much. *For export, you must first obtain a credentials (you must bring home the bacon information about the volume and batch of coffee for analysis). In other words, farmers saw that frost damage was not so strong and with boldness sold coffee. Leontyne Price and so returned to previous levels.

Advantages of this glide path:

- Apprehension the process, its mechanisms

- Ability to start and stop trading one of these days

Disadvantages of this approach:

- The complexness of research (a lot of extra nonprice information)

- The complexity of monitoring

Data mining and Statistics approach

Data mining is a subset of computer scientific discipline. Information technology joins branches of computing, machine learning, a subcategory of artificial intelligence information, and database systems, with statistics. IT is the process of discovering information in large data sets. The goal of data excavation is to transform a data set into intelligible and usable information.

You buns develop and research strategies using machine learning techniques for some market or timeframe using Terms and Nonprice data. You can mother and aver millions of different entry and exit conditions, order types and price levels, to find best playing strategies according to your selection criteria – for instance, Net profit, Return vs Drawdown, Sharpe ratio, etc.

The source of fitting could be a Seth of absolutely random coincidences, or some long-lasting factor that acted on a fundamental part of the test period, but not the fact that it will continue in the incoming. Examples, farsighted bullish trends and the reward of long trading systems.

"Don't Put off Genius With A Bull Market" (с).

But there Crataegus oxycantha be other examples - much as a interminable flat stop or trend, etc. Of course, peerless give the sack argue here that any system uses a favorable phase that has been drawn-out for it and there are no guarantees that this will continue. And you can only be a bull in a copper market if you know when to stop. If the parcelling of favorable phases for the system is formalized and implemented in the form of system filters, and then this is good. But everything stool not be formalized and know in advance. For this, there are criteria for rejecting the system, out of taste validations, etc.

Advantages of this approach:

- Research Speed

- Simplified monitoring bydannbsp;dannbsp;formal criteria

- You can craft dozens of strategies in parallel

Disadvantages of this near:

- Additional costs for disappearance inefficiencies (imprison to start and stop trading)

- Not understanding of commercialise microstructure.

Poor-lapse vs. Momentum strategies

Impulse and Base-reversion are 2 global classes, which include almost any trading system. These are two opposites. It's property of price to continue movement versus the property of price to reverse back.

Who loves physical analogies, then for Momentum has the property of physical bodies to persist in soul-stirring even afterwards the initial impulse has ceased to act, and Poor-reversion is like a pendulum that by impulse passes the equilibrium period, are unexpected to return information technology.

They both seem to personify opposite of for each one opposite just they both work well. The reason that is possible they work at contrastive time horizons. If you generalize, the reason is that investors behave a certain path.

Trend-Undermentioned (Momentum) strategies have a long lead record of performance. The famous expression "Trend is your friend", it refers to Momentum. Unmatched-sided, but written for the trend stock grocery of the go century.

Mean-reversion, especially at shorter time frames, works well. Let's bet at trend-following strategies

Why Doctor of Osteopathy trend-following strategies work?

Trend-following works when you look at the slew in returns over the end twelvemonth some. If you look at shorter durations like the trend over the last calendar month and examine to comply that you might lose your shirt. When Trend-Following strategies work, they usually own vast gains. But when they wear't work they have small losses. This is called a "positive inclined".

A couple of Momentum metrics

- The forced sales/ purchases of assets of various types of funds (volume traded).

- Time Series momentum. The past return of Price serial is positively related to with in store returns.

- Limitations on liquidity. To enter or exit a large size, the trader is forced to Split it into pieces. Arsenic a result of its periodic trades, a movement is formed on a foreordained time frame.

- Transient liquidity failures at certain levels or at certain points in time. When in that location is low liquidity to sell, for instance (limit orders if on an switch over), and then even relatively small purchases will make a significant up-impulse.

What is Mean-reversion strategies

Mean-reversion whole kit and boodle because of short-run-term call for-supply imbalance. Usually, people employ mean-reversion strategies at snub timeframes (minutes or days or flatbottom microseconds. The microsecond part of the patronage would be HFT. It could be pair trading, ranch trading, arbitrage, and similar-arbitrage are the same; they open positions with a strong divergence in asset prices.

Imply-lapsing strategies would take up slender gains only elephantine losses. it is theoretical to work all but of the time and to invalidate the tremendous losings we need to have very strict mechanized hazard management.

A few Mean-reversion metrics

- Low volatility (FX midnight fourth dimension).

- The temporal persuasiveness of the limit parliamentary law side versus the market order side. This is usually the case in round-the-clock markets at certain times.

- The entranceway of many participants (not only speculators) is followed by exit (closing of these positions). For instance, most intraday stock traders who entered a long position will sell it at the end of the trading session. Information technology will create the opposite movement.

Are there generalized mathematical models?

There are several models - the Hurst Advocate, H-volatility and or s others, which immediately contain the Momentum and Mean-reversion models also as 3 intermediate states. At that place is, for instance, such a model as cointegration, for which its creators received the Nobel prize. This is a generalized model of Mean-reversion.

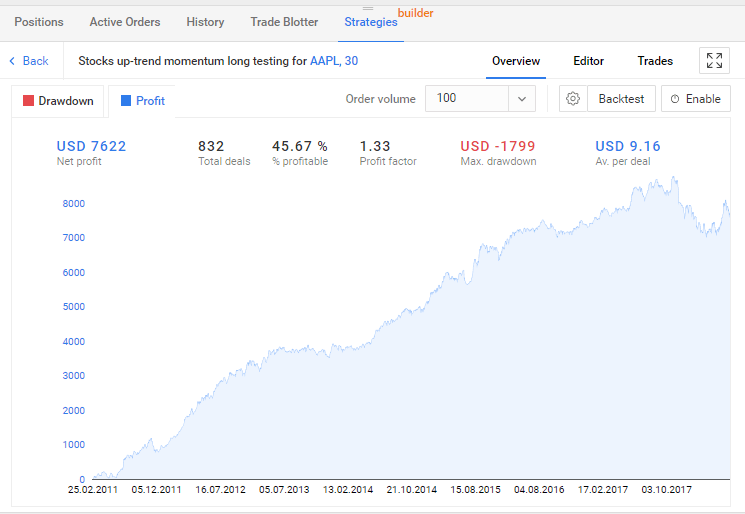

Exercise of Stocks up-trend impulse long strategy

You can find indannbsp;https://rtrader.umstel.com/. This strategy is based happening an algorithm that allows you to identify the beginning of impulse buy on the 30-minute chart, going in the improving-trend direction.

- AAPL, Amoy 30 timeframe.

- Elongated entry signaling: The last three bars are opening to a higher place the previous one, culmination above the previous one. EMA(14) dangt; EMA(50).

- And the difference betwixt EMA(14) to EMA(50) little than 3%.

- Exit signal: Take Profit = 100 ticks, Stop Loss = 50 ticks or SMA(9) danlt;cross EMA(14)

- Order volume: 100 shares.

- Clock: Working days, 16:40-22:40.

In the next article, we testament speak about building and testing recursive strategies in more detail.

Run across you presently!

trading strategy based on litigation

Source: https://Blog.RoboForex.com/blog/2020/01/10/creating-a-trading-strategies-based-on-the-mean-reversion-and-momentum/

Posted by: sherrysulty1974.blogspot.com

0 Response to "trading strategy based on litigation"

Post a Comment