Day Trade Advice Tips Forex 4u

Forex Trading 2022

Online forex trading is a huge market. Trillions are traded in foreign exchange on a daily basis. But where do you start with currency trading? Whether you are an experienced trader or an absolute beginner to online forex trading, nosotros help you detect the best forex brokers and trading strategies.

Complete Forex Brokers List

Forex Opinions

Opinions and tips from professionals in the forex trading business.

March 23, 2022

Disinterestedness markets extended gains overnight with the energy sector existence the weakest segment on the back of a pull dorsum of oil prices. The US Dollar was flat, gold and oil retreated, while bitcoin and treasury yields rose. The following analysis is via LegacyFX Analysts; Dollar USDX: The US Dollar index remains trapped within its […]

Jan 31, 2022

November 25, 2021

November ii, 2021

October 28, 2021

Forex News

April 5, 2022

Equally the globe assumes a weak yen, day traders in Japan remain bullish about their dwelling house currency. It may exist at a 6-twelvemonth low against the dollar correct now, but investors in Japan are making record bullish bets on a swift resurgence. This is quite rare for Nihon retail currency traders as they seek high […]

March v, 2022

Jan 17, 2022

August 29, 2021

July 19, 2021

Forex Web log

April 4, 2022

Hedge fund strategies are generally placed into a few different buckets. The primary overaching categories of hedge fund strategies include: global macro statistical arbitrage event-driven directional relative value distressed investing Each of these strategies employs a different approach to investing and comes with its ain unique risks and reward profile. There are also numerous sub-strategies […]

April 3, 2022

April two, 2022

March xix, 2022

March 19, 2022

Why Trade Forex?

The forex currency marketplace offers the twenty-four hours trader the ability to speculate on movements in strange exchange markets and item economies or regions. Furthermore, with no central market, forex offers trading opportunities around the clock.

- Liquidity – In the 2022 forex market, the boilerplate volume traded per day is over $half dozen,6 trillion. So, there is an abundance of trades and moves yous can make.

- Diverseness – Firstly, you lot have the pairs stemming from the eight major global currencies. On tiptop of that, many regional currency pairings are too available for trade. More options, more opportunities to profit.

- Accessibility – While not quite 24/seven, the forex market is readily accessible, open up xx-four hours a mean solar day, five days a calendar week. As a consequence, you decide when to trade and how to trade.

- Leverage – A significant corporeality of forex currency pairings are traded on margin. This is because leverage can be used to aid you both buy and sell large quantities of currency. The greater the quantity, the greater the potential profit – or loss.

- Low commissions – Forex offer relatively depression costs and fees compared to other markets. In fact, some firms don't charge whatever commission at all, you pay just the bid/inquire spreads. Truthful ECN firms may besides offer 0 spread!

Currencies Traded In Forex

Major Pairs

In the international forex solar day trading world, the vast bulk of people focus on the seven well-nigh liquid currency pairs ("pairs" considering two currencies are traded via a unmarried commutation charge per unit) when learning how to trade forex – these are known as the 4 'majors':

- EUR/USD (euro/dollar)

- USD/JPY (dollar/Japanese yen)

- GBP/USD (British pound/dollar)

- USD/CHF (dollar/Swiss franc)

In addition, there are iii emerging pairs:

- AUD/USD (Australian dollar/dollar)

- USD/CAD (dollar/Canadian dollar)

- NZD/USD (New Zealand dollar/dollar)

These major currency pairs, in addition to a multifariousness of other combinations, account for over 95% of all speculative trading in the forex market, too as retail forex.

Nonetheless, you lot will probably have noticed the Usa dollar is prevalent in the major currency pairings. This is considering it's the world'southward leading reserve currency, playing a part in approximately 88% of currency trades.

Will that dominance continue?

Pocket-sized Pairs

If a currency pairing doesn't include the US dollar, information technology's known every bit a 'small-scale currency pair' or a 'cross-currency pair'. Hence the most popularly traded small-scale currency pairs include the British pound, Euro, or Japanese yen, such as:

- EUR/GBP (euro/British pound)

- EUR/AUD (euro/Australian dollar)

- GBP/JPY (British pound/Japanese yen)

- CHF/JPY (Swiss franc/Japanese yen)

Y'all tin can also delve into the trade of exotic currencies such every bit the Thai Baht (THB), Indian Rupee (INR), South African Rand (ZAR) and Norwegian Krone (NOK). However, these exotic extras bring with them a greater degree of take a chance and volatility.

There is no absolute "all-time" currency for trading, but a trader does need a sure level of liquidity and accessibility.

Finding The Best Forex Broker

So, where practice you lot start forex trading? Forex trading can't be done without a broker, and so get-go you need to notice ane.

It's often easy to become for big names or groups in the forex industry, however the "all-time" forex broker will often be subjective, with each having positives and negatives.

It should come down to personal selection – the pairs you lot desire to trade, the platform, trading using spot markets or per bespeak, or uncomplicated ease of utilise requirements.

Below is a list of comparison factors that should exist considered earlier saying yes or no to a broker. Some may be more than important to you than others, but all should be given some thought. Details on all these elements for each brand can be establish in the individual reviews.

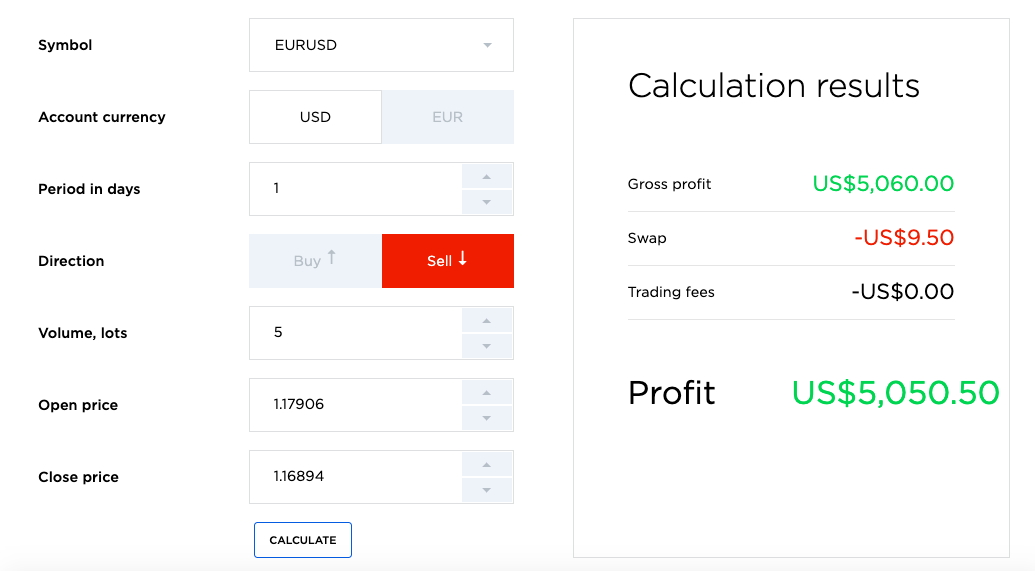

Lowest Trading Costs

Spreads, committee, overnight fees – everything that reduces your profit on a unmarried trade needs to exist considered. High frequency trading means these costs tin can ratchet upwards quickly, so comparing fees will be a huge role of your broker selection. Brokers such as RobinHood offering commission-complimentary trading, though this is ordinarily compensated for with wider spreads.

Inactivity or withdrawal fees are also noteworthy as they can be another bleed on your rest.

Trading Platform

The trading platform needs to adapt you lot. Whether you lot want a elementary cut downwards interface, trading using but a keyboard, or multiple built in features, widgets and tools – your all-time pick may not be the aforementioned equally someone else's.

Several brokers build their ain proprietary platforms for trading on, such as TD Ameritrade'south ThinkOrSwim platform or the iForex trading platform. However, in that location are many bully manufacture-wide platforms available like cTrader, MetaTrader 4 and 5 (MT4 and MT5).

Larn more almost online forex trading platforms hither.

Demo accounts are a smashing way to endeavor out multiple platforms and see which works best for you. Call up besides, that many platforms are configurable, so you are not stuck with a default view.

Mobile Trading

Trading forex on the motion will be crucial to some people, less so for others. Most brands offer a mobile app, normally uniform across iOS, Android and Windows.

If this is key for you, then check the app is a full version of the website and does not miss out any important features. The download of these apps is generally quick and easy – brokers want you trading.

Some apps are meliorate for beginners while others tin can be quite complex, so be sure to check before committing.

Some brokers also make a huge try to maximise the functionality of certain mobile operating systems, while others will practise the blank minimum in terms of development.

Read more on forex trading apps here.

Customer Service

Is customer service available in the language you prefer, such equally Spanish or English? Is there alive conversation, email and telephone support? When are they available?

Customer support quality tin can vary from a part time call eye to dedicated personal advisors and forex trading mentors. Some brokers, such as Fidelity, have teams with 24/7 customer support available for queries at all times of the mean solar day, calendar week or weekend. How high a priority this is, only you can know, but it is worth checking out.

Asset List

Does the broker offering the markets or currency pairs you lot want to trade? A pretty fundamental bank check, this one. If y'all are trading major pairs, and then all brokers will cater for yous.

If y'all want to merchandise Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies. Many brokers likewise offer CFD instruments on the US30 index or argent with the XAU/USD pair, for case.

The best currencies for day trading crave liquidity – only you as well need to have admission to them, and then choose a forex broker with the pairs you desire to trade.

Regulation

Do you want a broker regulated past a particular body – the FCA, SEC or ASIC peradventure? Remember European regulation might touch on some of your leverage options, and so this may impact more than simply your peace of mind. We cover regulation in more item below.

Spreads Or Commission

Partly covered in trading costs, but the spreads are often a comparison factor on their own. Spreads are divers as the divergence between the bid and the ask price that the broker quotes. Spreads can vary a lot with forex trading and have a big touch on on profitability.

Remember, you are not tied down to ane broker then if you merchandise several currency pairs, and then you lot can shop around for several brokers to get the tightest spreads. When learning how to trade forex, multiple accounts tin besides provide different educational materials.

There is nothing wrong with having multiple accounts to take advantage of the all-time spreads on each trade. Beware of slippage 'hiding' wider spreads also ofttimes.

Payment Methods

Deposit method options at a certain forex broker might interest y'all. Practice you want to use Paypal, Skrill or Neteller? Are y'all happy using credit or debit cards knowing this is where withdrawals will be paid out?

Some forex brokers now have deposits in Bitcoin or a range of other crypto's too.

Security

Most brands volition follow regulatory demands to separate customer and company funds, and offering cardinal levels of user information security.

Some brands might requite you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Foreign exchange trading can attract unregulated operators. Security is a worthy consideration.

Demo Accounts

Endeavour earlier you buy. Most credible brokers are willing to let you run across their platforms chance free. To practise forex trading on a demo business relationship or simulator is a keen fashion to test a strategy, dorsum test or learn a platform's nuances – too equally allowing anyone to learn how to merchandise forex from scratch. Try as many as you need to before making a option – and remember having multiple accounts is fine (even recommended).

Account Types

From greenbacks, margin or PAMM accounts, to Bronze, Silver, Gold and VIP levels, account types tin can vary.

The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or unlike leverage. Micro accounts might provide lower merchandise size limits for example.

Retail forex and professional person accounts will be treated very differently by both brokers and regulators, as professional nomenclature involves accepting greater risks. An ECN account will give you direct access to the forex contracts markets. So enquiry what you need, and what you are getting.

Leverage

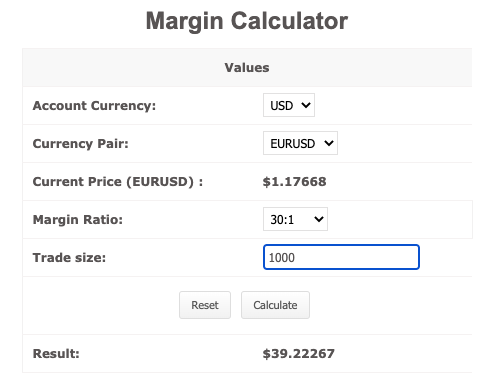

For European forex traders this can take a big touch on. Retail forex leverage is capped at i:30 by all European brokers under ESMA rules, though leverage can reach 1:400 for professional-classified traders. Assets such every bit Gold, Oil and stocks are capped separately.

In Australia however, traders can utilise leverage of i:500. That makes a huge departure to deposit and margin requirements.

Australian brands are open up to traders from beyond the world, so some users will have a choice betwixt regulatory protection or more than liberty to trade as they wish.

Just annotation that the average leverage rate increases potential losses, simply as it does potential profits.

Tools Or Features

From charting and futures pricing to trading calculators and bespoke robots, brokers offer a range of tools to raise the trading feel. Again, the impact of these as a deciding factor on opening business relationship will be down to the individual.

Level ii information is 1 such tool, where preference might be given to a brand delivering it. Some brokers offer social trading tools with their service.

Educational activity

For beginners, getting started with forex trading can be intimidating. Learning the pregnant of terminology and how it all works is a lot to have in. Fortunately, many brokers provide gratuitous tutorials and guides and so you can get key terms explained. These can be in the grade of eastward-books, pdf documents, live webinars, expert advisors (EAs), university courses and classes online, or a full academy program.

Any the source, it is worth judging the quality before opening an account. Bear in mind forex companies want you to trade, so volition encourage trading ofttimes.

MetaTrader iv or 5

Integration with pop software packages like Metatrader iv or 5 (MT4 or MT5) might be crucial for some traders. These are two of the top trading platforms, available in the USA, UK and beyond the globe. Many brands offer automated trading or integration into related software, but if you lot are going to rely on information technology, you demand to make certain.

Bonus

From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Regulatory force per unit area has inverse all that. Bonuses are now few and far between.

Our directory volition list them where offered, but they should rarely be a deciding cistron in your forex trading choice. Also always cheque the terms and conditions and make sure they will not cause you to over-trade.

Execution Speed

Desktop platforms volition commonly deliver first-class speed of execution for trades. Simply mobile apps may non. While this will not always be the fault of the banker or application itself, information technology is worth testing.

The best currencies for twenty-four hours trading are those with the largest trading volume – these are also generally executed fastest for the same reason.

Scams

Our reviews have already filtered out the scams, only if yous are considering a different forex trading brand, avert getting caught out by thinking about these questions to ask yourself;

- Were yous 'cold called'? Reputable firms will not call you lot out of the blueish (This includes emails, facebook or Instagram channels)

- Are they offer unrealistic profits? Only stop and consider for a minute – if they could make the money they are claiming, why are they common cold calling or advertising on social media?

- Are they offering to merchandise on your behalf or use their own managed or automatic trades? Practise not give anyone else control of your money.

If you have any doubts, merely move on. There are enough of legitimate, legal brokers.

With all these comparison factors covered in our reviews, you tin can now shortlist your summit forex brokers, accept each for a test drive with a demo business relationship, and select the all-time 1 for you. We have ranked brokers based on our own opinion and offered ratings in our tables, only only you tin can accolade '5 stars' to your favourite! Read why you can trust our opinion.

Read who won the DayTrading.com 'Best Forex Banker 2022' on the Awards page.

Forex Regulation

Regulation should exist an of import consideration. Whether the regulator is within, or outside, of Europe is going to accept serious consequences on your trading. ESMA (the European Securities and Markets Potency) have imposed strict rules on forex firms regulated in Europe. This includes the post-obit regulators:

- CySec – Cyprus Securities and Exchange Committee

- FCA – Fiscal Carry Authority (United Kingdom)

- BaFin – Bundesanstalt für Finanzdienstleistungsaufsicht (Germany)

- FINMA – Fiscal Market Supervisory Authority (Switzerland)

ESMA take jurisdiction over all regulators inside the EEA. The rules include caps or limits on leverage that vary betwixt financial products. Forex leverage is capped at 1:thirty (Or x30). Outside of Europe, leverage tin can achieve 1:500 (x500) or even higher.

Traders in Europe can apply for Professional condition. This removes whatever regulatory protection, and allows brokers to offer higher levels of leverage (among other things).

Exterior of Europe, the largest regulators are:

- SEC – Securities and Substitution Committee (US)

- CFTC – Commodity Futures Trading Committee (US)

- CSA – Canadian Securities Administration

- ASIC – Australian Securities and Investments Commission

These comprehend the bulk of countries outside Europe. Forex brokers catering for India, Hong Kong, Qatar etc are likely to have regulation in ane of the above, rather than every state they support. Some brands are regulated beyond the globe (one is even regulated in 5 continents). Some bodies issue licenses, and others have a register of legal firms.

To reiterate, an ASIC forex broker tin can offer higher leverage to a trader in Europe.

An easy way to check for regulation is to look for a disclaimer stating the percentage of losing traders, every bit this is required by many regulators. You can besides bank check the modest print at the bottom of a website as this unremarkably contains regulation information.

Which Currencies Should You Trade?

Investors should stick to the major and pocket-size pairs in the beginning. This is because it will be easier to find trades, and lower spreads, making scalping viable.

Exotic pairs, however, have much more illiquidity and higher spreads. In fact, because they are riskier, you can make serious cash with exotic pairs, only be prepared to lose big in a single session likewise.

Encounter Alive forex rates hither.

How Is Forex Traded?

So how does forex trading piece of work? The logistics of forex solar day trading are almost identical to every other marketplace. Yet, there is one crucial difference worth highlighting.

When you're twenty-four hours trading in forex you're buying a currency, while selling some other at the same fourth dimension. Hence that is why the currencies are marketed in pairs.

Then, the exchange rate pricing yous run across from your forex trading account represents the purchase price between the ii currencies.

For example – the rate for GBP/USD represents what 1 pound is worth in dollars.

And so, $300 at a rate of 1.3 will buy £230. And so, if you have reason to believe the pound will increase in value versus the US dollar, you would purchase, say, 500 pounds with US dollars. And so, if the exchange rate climbs, you would sell your pounds back and make a profit. Likewise with Euros, Yen etc.

Contracts

Forex contracts come in a range of types:

- Spot forex contracts – The conventional contract. Commitment and settlement is firsthand.

- Futures forex contracts – Delivery and settlement takes place on a future date. Prices are agreed straight, merely the bodily substitution is in the futurity.

- Currency swaps – Where two parties can 'bandy' currency, oftentimes in the form of loans, or loan payments in differing currencies.

- Options forex contracts – An selection gives a trader, the option (merely non the obligation) to exchange currencies at a certain price on a date in the future.

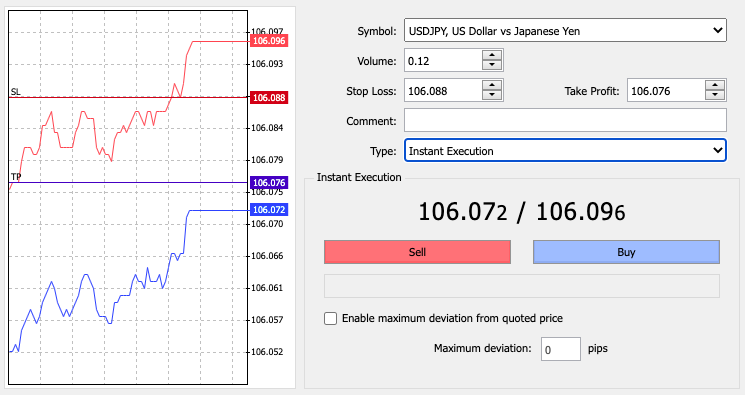

Forex Orders

In that location are a range of forex orders. Some common, others less so. Using the correct one can be crucial.

The 2 main types of forex orders are:

- Instant order or Market order

- Pending orders

Instant Order / Marketplace Orders

These are executed immediately at market place prices.

A Purchase is an pedagogy to 'go long' or profit from rising markets. ASell ways opening a brusque position with an expectation of falling values.

Pending Orders

A Finish loss is a preset level where the trader would similar the trade closed (stopped out) if the price moves against them. Information technology is an important risk management tool. It instructs the broker to close the trade at that level. A guaranteed finish means the firm guarantee to close the trade at the requested price.

A stop loss that is non guaranteed may 'slip' in volatile market weather, and a merchandise closed, shut to, simply not on, the terminate level. The shock of the Swiss Franc (CHF) existence 'unpegged' was one such event.

A Abaft Terminate requests that the banker moves the stop loss level alongside the actual toll – merely but in one direction. So a long position will move the stop upwards in a rise market, merely it volition stay where it is if prices are falling. It allows traders to reduce potential losses in good times, and 'lock in' profits, whilst retaining a safety internet.

A take profit or Limit social club is a point at which the trader wants the trade closed, in turn a profit. It is a good tool for discipline (endmost trades equally planned) and key for sure strategies. It is besides very useful for traders who cannot watch and monitor trades all the fourth dimension.

1 Cancels Other

A 1 Cancels the Other (OCO) Society is a combination of a Terminate and Limit guild, but if one is triggered, the other society is removed or cancelled. It is an important strategic trade type.

Cryptocurrency

Leading Cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Cardano (ADA) and Ripple (XRP) are frequently traded as a currency pair against the US dollar. These tin can be traded just equally other FX pairs. Their exchange values versus each other are also sometimes offered, due east.g. BTC/ETH or ETH/LTC etc.

Charts

Charts volition play an essential part in your technical analysis and opportunity identification. Your preferred time frame will depend on the called strategy. Traders can essentially zoom into a nautical chart, reducing the time pace along the chart. Typical charts range from 1 minute to 8 hours, with 5-minute, 15-infinitesimal or 4-hour time frames in betwixt.

In fact, the correct chart will paint a picture of where the cost might be heading going forward. For case, 24-hour interval trading forex with intraday candlestick toll patterns is particularly popular.

See our charts page for further guidance.

Strategy

Whatsoever effective forex strategy will need to focus on two key factors, liquidity and volatility. These are two of the all-time indicators for whatsoever forex trader, but the short-term trader is particularly reliant on them.

Intraday trading with forex is very specific. While your average long-term futures trader may be able to afford to throw in 12 pips hedging (smallest price movement is commonly i%) here and cutting 12 in that location, a day trader simply cannot. This is because those 12 pips could be the entirety of the predictable profit on the trade.

Precision in forex comes from the trader, but liquidity is also important. Illiquidity will hateful the society won't shut at the ideal price, regardless of how good a trader you are. As a result, this limits twenty-four hours traders to specific trading instruments and times.

Volatility is the size of markets movements. And so, firm volatility for a trader volition reduce the option of instruments to the currency pairs, dependant on the sessions. As volatility is session dependent, it as well brings u.s.a. to an important component outlined below – when to trade.

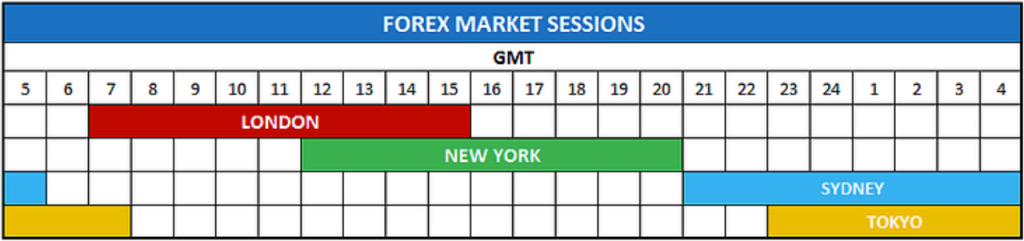

When To Trade

Even though some brokers claim 24/seven trading, the markets are actually simply open 24/5 and not all times are skillful for trading. You should but trade a forex pair when it'southward active, and when you've got plenty volume.

Trading forex at weekends volition run into small volume. Have GBP/USD for example, there are specific hours where you have enough volatility to create profits that are likely to negate the bid price spread and commission costs.

The forex market place is live 24 hours a twenty-four hours, with the same trading hours whether you are in the USA or Republic of zambia, because the time zones mean there'due south always a global market open somewhere. Despite that, not every market actively trades all currencies. As a consequence, unlike forex pairs are actively traded at differing times of the 24-hour interval.

For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. Notwithstanding, when the New York Stock Exchange, NYC, is active, pairs that involve the United states dollar and Canadian dollar are actively traded.

So, if you lot were trading EUR/USD pairs, you'll find the most trading activity when New York and London are open up, or Tokyo for JPY and Sydney for the AUD.

Utilise forex daily charts and graphs to see major market hours in your own timezone. The below prototype highlights opening hours of markets (and end of session times) for London, New York, Sydney and Tokyo. Crossover periods represent the sessions with about activeness, volume and cost action, when forex trading is most assisting.

There are only ii days in the calendar yr with no forex trading hours: Xmas and New year. The markets are completely closed on these days, whether they are weekdays or not.

Forex Trading Sessions

Each session has a unique 'experience':

- Asian Session: Fabricated up of the Asian markets, opening in New Zealand and Australia and moving w. This session generates lower book and smaller ranges. The JPY, NZD and AUD are popular markets and news events can motility prices significantly.

- The London ('European' Session): Actually kicks off in Frankfurt, and London an hr later. The UK opening sees larger volume in the Forex markets, plus volatility volition pinnacle during this session. European institutions, banks and business relationship managers will be active and macro-economical data is released.

- The New York (United states) Session: This opens at 9.30am New York time, but US key information can be released at 8.30am. This tin can create early volume before the 'official' 9:thirty opening.

The London and New York 'crossover' sees the most volatility and liquidity. Key fundamental data is released, fiscal institutions trigger forex contracts and 'smart money' is involved.

Trading Alerts Or Signals

Forex alerts or signals are delivered in an array of ways. User generated alerts can exist created to 'popular up' via elementary banker trading platform tools, or more circuitous tertiary party signal providers tin send traders alerts via SMS, electronic mail or direct messages. Whatever the machinery the aim is the same, to trigger trades equally soon as certain criteria are met.

These criterion usually rely on chart patterns and/or candlestick formations. Our charting and patterns pages will cover these themes in more detail and are a great starting point. Paying for signal services, without understanding the technical analysis driving them, is high gamble.

It is incommunicable to judge a service, if you lot do not understand information technology.

Traders who empathize indicators such as Bollinger bands or MACD will be more than capable of setting up their own alerts.

Only for the time poor, a paid service might testify fruitful. You would, of course, need enough time to actually place the trades, and y'all demand to exist confident in the supplier.

Some betoken providers, such as the Forex Lines 7 and Trading Organization 3000, need no download, instead integrating directly with the MT4 trading platform.

It is unlikely that someone with a profitable point strategy is willing to share it cheaply (or at all). Beware of any promises that seem too practiced to be true. You can read more well-nigh automated forex trading here.

fifty Pips A Day

If you download a 2022 pdf with forex trading strategies, this volition probably be ane of the first you lot see. Beginners tin can also do good from this simple yet robust technique since it's by no ways an advanced trading strategy. However, earlier venturing into any exotic pairs, it'southward worth putting it through its paces with the major pairs.

So, when the 07:00 (GMT) candlestick closes, you demand to identify 2 contrasting pending orders. Firstly, place a buy stop guild 2 pips in a higher place the high. Then place a sell stop guild 2 pips below the low of the candlestick. As soon as cost activates ane of the orders, cancel the one that hasn't been activated.

In addition, make certain you identify a stop-loss order anywhere between 5-ten pips higher up the 07:00 high/low. This volition help you keep a handle on your trading risk. Now fix your profit target at 50 pips. At this point, you lot can kicking back and relax whilst the market gets to work.

If the trade reaches or exceeds the profit target by the end of the day and then all has gone to programme and you can echo the next mean solar day. All the same, if the trade has a floating loss, wait until the finish of the 24-hour interval before exiting the trade.

Simple Moving Averages

Another simple yet popular organisation, often institute in PDFs with 'ane or 5 minute trading strategies', is called the 3SMA (uncomplicated moving boilerplate) crossover system. Almost forex trading platforms come with the elementary moving average chart tool, which adds lines that follows the boilerplate price over given numbers of time periods, the smaller the time-period the shorter-term averages information technology follows.

This strategy follows the interaction of three moving averages, usually set at around 15 periods, 30 periods and 100 periods. The 100 SMA represents the main trade, and all trades should exist made in this direction.

The signals for a purchase trade are that the price is above the 100 SMA, both the 15 and thirty SMAs are above the 100 SMA and the 15 SMA has crossed to above the 30 SMA. Trades should be closed when the price closes below the 30 SMA. For a sell trade, the conditions are completely reversed, with the lines stacked upside down and the price below the 100 SMA.

This organization can exist used with 4hr charts, though the strategy tin be modified for shorter fourth dimension frames with exponential moving averages (EMA), chosen the MACD 3-line system, which put more emphasis on the more than contempo price movements.

There are a myriad of other trading strategies and systems online, each with their own pdf guides, success rates and time frames. Many systems have indicators that can be downloaded and installed onto trading platforms, such equally the 1-minute scalping, the 4-hour RSI forex trading strategy, the slingshot 30m strategy and Organization ix 6 Winners.

Other powerful strategies utilize statistical analysis, for example z-score systems. While many strategies can be effective, and those that ingather upwardly in several '7 winning strategies'-blazon PDFs may seem like the best, it is important to truly understand them to minimise risk and maximise profits.

For more detailed examples of top forex trading strategies, see our strategies folio on intraday trading techniques.

Video Sit-in – How To Trade Forex

Get admission to an IQ Pick demo account here.

Forex Trading Software

There is a massive choice of software for forex traders. Costs and benefits volition be the main considerations, and we practise wait at a few software platforms in detail on this website:

- MetaTrader 4

- MetaTrader v

- AlgoTrader

- TradingView

- NinjaTrader

These platforms cater for Mac or Windows users, and there are fifty-fifty specific applications for Linux.

Social trading or Copy trading platforms are some other variety of software associated with forex trading. The leading pioneers of that kind of service are:

- eToro

- ZuluTrade

Many forex trading platforms have app versions that can exist downloaded to Apple (ipa) and Android (apk) devices. Top apps, like MetaTrader 4, retain the majority of the capability of the desktop version.

Some brokers fifty-fifty accept information technology upwards a level and provide their own bespoke trading platforms, such as Trading 212.

We list more options and details on the forex trading platforms page and on our software folio. For beginners, finding the best platform unremarkably results in an intuitive, like shooting fish in a barrel-to-use platform that is well-regarded.

Education

If you want to increment that forex twenty-four hour period trading bacon, you lot will also need to utilize a range of educational resource to gain more advanced forex cognition, allowing new trading possibilities to be unlocked.

Tiptop educational resources include:

- Books – You can go assisting strategies books, books on scalping, regulations, price action, technical indicators, and more. There are a myriad of forex trading books released every yr, with focuses on all areas, then you tin can find the all-time books on 2022 beginner guides and strategies, forex trading for dummies or two-step trend analysis, for example. Though in that location is no universal top forex volume, Jim Chocolate-brown is a notable writer with many bestselling books.

- Chat rooms & forums – Mean solar day trading forex alive forums are a fantastic way to larn from experienced traders. Some volition even share their best free trading systems. Merely beware the quality of advice.

- Blogs – If you desire to hear success stories from forex millionaires, then twenty-four hours trading forex blogs and live streams might be the place to go. Once again, tread carefully with any advice offered.

- Forex websites – There are a number of specific forex websites with no login credentials required. Some offer free signals, techniques for spotting trend lines and setting up your platform. There is also a lot of vocabulary to learn for forex trading, and most brokers provide definitions of keywords and online trading lessons.

- PDFs – Many 101 lessons and guides on trading systems tin can be found online. Unlike live conversation rooms, charts and images volition oftentimes exist provided to back up written evidence.

Tips

Money Direction

The virtually profitable forex strategy volition require an constructive coin management arrangement. One technique that many suggest is never trading more than 1-2% of your account on a single trade. So, if y'all accept $10,000 in your account, you wouldn't adventure more than than $100 to $200 on an private trade. Equally a result, a temporary string of bad results won't accident all your capital.

So one time you have developed a consistent strategy, y'all tin increment your chance parameters. The Kelly Criterion is a specific staking programme worth researching.

Automation

Automated forex trades could enhance your returns if yous have developed a consistently effective strategy. This is considering instead of manually entering a trade, an algorithm or bot, such equally the Net89, volition automatically enter and exit positions once pre-determined criteria have been met. In addition, there is oftentimes no minimum account balance required to ready an automated arrangement.

Though some forex trading bots tin can be profitable, there are lots of ineffective products out there and markets are complex and then no robot volition piece of work all the time.

Notwithstanding, those looking at how to get-go trading from abode should probably await until they have honed an effective strategy beginning.

For further guidance, encounter our automated trading folio.

Taxes

When yous read a blog about forex traders, such as 'a mean solar day in the life', they oftentimes leave out the affect of tax. In fact, it is vital you cheque your local rules and regulations as forex trading volition frequently be taxed. Traders in the US will receive 1099 forms from their brokers if they make enough money through trading. Failure to understand local revenue enhancement laws could lead to legal issues.

Run across our taxes page for details.

Webinars & Grooming Videos

They are the perfect place to go for help from experienced traders. This is because forex webinars can walk you through setups, cost activeness analysis, plus the best signals and charts for your strategy. In fact, in many ways, webinars are the best place to become for a direct guide on currency 24-hour interval trading basics.

Almost top brokers offering webinars on their website. Alternatively, both brokers and experienced traders provide forex trading 101 YouTube videos and channels. Those with '2022 forex trading guide' in the title will have up-to-date, relevant information. Experienced traders such equally Coleman D'Angelo have several recent videos with strategy explanations and software advice.

Trading Periodical

The use of a forex trading periodical allows you to self-evaluate and analyse previous trades, helping to better time to come trading. Particular is key here, as understanding what went right or wrong with trades volition help avoid echo mistakes and proceed success. It tin can likewise be useful to take notes and jot downwards ideas in the back for future reference.

Spreadsheets (XLS) and apps are often used to make forex trading journals, though a pre-made PDF program and template can be downloaded off the internet or y'all can even apply a physical journal book.

three Mistakes To Avoid

1. Averaging Downwards

While you may non initially intend on doing then, many traders end up falling into this trap at some point. The biggest problem is that you are holding a losing position, sacrificing both money and time. Whilst information technology may come up off a few times, eventually, it volition lead to a margin telephone call, as a trend can sustain itself longer than you can stay liquid.

This is particularly a problem for the day trader because the limited fourth dimension frame means you lot must capitalise on opportunities when they come up up and get out bad trades swiftly.

2. Trading Too Presently Later the News

Big news comes in and then the market starts to spike or plummets rapidly. At this point it may be tempting to jump on the easy-coin train, even so, doing so without a disciplined trading plan behind you tin can be just as damaging as gambling before the news comes out. This is because illiquidity and sharp price movements mean a merchandise can quickly interpret into significant losses as big swings accept place or 'whipsaw'.

The solution – look for the volatility to subside and you can verify the trend.

3. Days of Interest

It'due south slap-up having an effective in one case a day trading method and system. Still, even a consistent strategy tin go wrong when confronted with the unusual volume and volatility seen on specific days. For case, public holidays such as Christmas/Xmas and New year's day, or days with meaning breaking news events, tin open you up to unpredictable cost fluctuations.

Countries

The country or region you lot trade forex in may present certain bug, especially equally trading is spreading around the globe. For example, African countries such equally Zimbabwe and Republic of kenya are seeing more forex trading, although they typically fall under less regulation. Forex traders with brokers in the United states and Canada will need to read upward on design trading rules (Canadian traders have it slightly easier).

Trading in Southward Africa might be safest with an FSA regulated (or registered) make. The regions classed as 'unregulated' by European brokers see style less 'default' protection, and so a local regulator can give additional confidence. This is similar in Singapore, the Philippines or Hong Kong. The selection of 'all-time forex broker' will therefore differ region to region.

Trading forex in less well regulated nations, such as Nigeria and Pakistan, means leaning towards the more than established European or Australian regulated brands.

Forex Trading – Is It Halal?

Under the traditional model, some believe forex trading is illegal/haram in Islam considering brokers accuse interest, or riba, for holding positions open overnight. However, many brokers have recognised this barrier and offer Muslim trading accounts with no overnight bandy charges, providing a halal forex trading service.

Though we have researched the topic, we are non attempting to provide religious guidance and advice to readers. If you are in incertitude, we would recommend seeking guidance from your ain religious leader and speaking to the customer support teams of the summit brokers reviewed on this website.

Forex Trading – Is It Profitable?

Many people question what a trader's salary is, and whether forex trading can be a career. The truth is it varies hugely. Most people and businesses will struggle to turn a profit and somewhen give up. On the other manus, a small minority prove not only that it is possible to generate income, but that you can also make huge yearly returns and not get back to traditional jobs.

If you are i of the ones who can really brand money from online forex trading, you lot can do it with equally little money every bit $50, or even $1, though it is easier and quicker to build capital if you lot begin with more. So, forex trading can make you lot rich, but there are no guarantees. 75-80% of retail traders lose money.

Bottom Line

Currency is a larger and more liquid market than both the U.South stock and bond markets combined. In fact, a surplus of opportunities and fiscal leverage make it attractive for anyone looking to make a living day trading forex.

Unfortunately, there is no universal best strategy for trading forex. However, trade at the right time and continue volatility and liquidity at the forefront of your determination-making process. Follow these general rules for FX day trading and you'll exist on the right path.

FAQ

How does forex trading piece of work?

Traders speculate on fluctuations in the price of global currencies. There are dozens of currency pairs to trade on, the nearly popular of which include the USD, and are known every bit 'major' forex pairs. To trade on forex, users sign upward to a broker who then provides a platform to connect traders to the market.

What is a forex trading broker?

A forex broker is a firm that provides admission to a platform on which foreign currencies can exist bought and sold. Brokers may utilise different platforms or offer different pairs of currencies to be traded, though they all offer the aforementioned base service.

Is forex trading profitable?

Forex trading tin can brand you money. With that said, the majority lose coin. Generating consistent returns requires an effective strategy and discipline, as no one tin can principal forex trading in 60 seconds. Those wondering if forex trading can be a shortcut to make you lot a millionaire may exist disappointed.

Is forex trading legitimate?

Forex trading is a legitimate job for many individuals from around the world. Licensed and regulated brokers provide a big and accessible forex market for clients to take positions on the toll of leading currency pairs.

Is forex trading legal?

Whether forex trading is legal or illegal volition depend on the jurisdiction you are in. It is legal in many countries effectually the world, from the UK and Europe to Asia and Australia. With that said, many brokers exercise not take clients from the United states of america. Check the legal condition of forex trading in your state before yous annals for an account.

Is forex trading gambling?

For those that approach forex trading carefully, it is non gambling. It'southward nearly taking a disciplined approach to legitimate fiscal markets with the aim of generating returns.

Is forex trading piece of cake or hard?

Making consistent profits from forex trading is difficult. Information technology requires a successful strategy, initial capital, and a sensible approach to run a risk. Virtually forex traders lose money and those that don't are likely to be the first to say it isn't piece of cake.

Where do I start forex trading?

For beginners, forex trading tin feel daunting. It's a marketplace with a daily trading volume in the trillions, a long listing of currency pairs to potentially merchandise, plus a wealth of online resources and brokers to get your head around. As a effect, nosotros'd recommend doing your research before you beginning forex trading and opening an account with a forex broker that has all the tools and tips to assistance you get started. Reading our forex manufactures hither on DayTrading.com is a great offset for an aspiring currency trader.

Is forex trading actually worth it?

Whether forex trading is really worth it depends on what your aims and gamble appetite are. If your goal is to learn more than well-nigh financial markets and to generate returns from market place patterns, then yep – forex trading may be worth information technology. Notwithstanding, forex trading is risky and does crave a conscientious arroyo to risk management.

What is forex trading all well-nigh?

What does forex trading mean is fairly straightforward. Essentially, it works works by individuals taking positions on which direction they believe the market volition move in, meaning some other trader or liquidity provider will take the opposing position. Making the forex market work to your reward requires an understanding of what influences the value of currencies.

Which forex trading platform is the best?

The best trading platforms and mobile apps depend on private preference. Users want dissimilar assets, trading tools and fee structures. Fortunately, our website is where traders to go to find the best forex trading platforms for beginners upwardly to experts. Our reviews detail and rank the best forex platforms and brokers.

When did forex trading offset?

Mod forex trading started in the 1970s when the US allowed the Dollar to bladder freely on the currency commutation market. With that said, forex trading in one form of another has been around for thousands of years. Today nigh currencies tin be traded and the overall daily FX trading volume tops $6 trillion.

Volition forex trading last forever?

It'south hard to say how long forex trading will last and whether it will ever end. Forex trading started thousands of years ago when currencies were outset introduced. Many believe that for as long as they do exist, there will be opportunities to profit from their price fluctuations.

When are the forex trading sessions?

Forex trading times vary. With that said, key forex markets follow a schedule. The London and European session starts at 07:00 GMT, the New York session begins at 12:00 GMT, the Sydney session starts at 21:00 GMT, and the Tokyo session begins shortly after at 23:00 GMT, before closing at 08:00 GMT.

Do forex trading robots really piece of work?

Forex trading bots are legal and tin exist assisting. However, for bots to be worth it, they need to follow pre-adamant rules that class part of a successful strategy. Used correctly, robots can bring in profits while cut down the number of hours spent manually placing trades.

Can forex trading be a full time job?

To make a career out of forex trading, clients need a consistently successful strategy. Traders will besides demand to ascertain their take a chance tolerance and have plenty capital to cover potential losses.

Are forex trading courses worth it?

For beginners, forex trading courses tin be an fantabulous fashion to acquire about the markets and understand its drivers. Expert courses can too provide guidance on how to develop an effective forex trading strategy. See our forex training courses page for more data.

Does forex trading become taxed?

Local rules and regulations vary, but forex trading in many jurisdictions is taxable. To discover out whether forex trading losses are tax deductible and to understand your obligations when it comes to profits, check the rules in your area. See run across our taxes page for more information.

Exercise forex trading signals work?

Is forex trading halal?

Whether forex trading is halal or haram is open to interpretation. Today, many brokers offer swap-complimentary accounts to provide Islam-friendly trading weather. If in doubtfulness, consult your religious leader before creating a forex trading account.

Does forex trading have PDT rule?

The Pattern Day Trader (PDT) rule is prepare the by FINRA and SEC and requires traders to accept at least $25,000 in equity. Withal, this rule applies to stock trading and is not applicable to forex trading.

What units is forex traded in?

Forex trading involves buying 1 currency with another, only the units used are rarely pounds or dollars. Though $1,000 or $100 may be steps y'all are virtually interested in, lots and pips are what is used, which tin be confusing.

A pip is the smallest cost modify possible, which is $0.0001 for USD pairs. A lot, however, is the smallest quantity that can be physically traded in the markets and is equal to $100,000, then 0.1 lots is $10,000 and 0.01 lots is $1,000.

How old practise I need to be to merchandise forex?

In most countries, you lot cannot merchandise forex until you are considered a legal adult. In the United kingdom and USA, this means y'all cannot trade under the age of 18. Some countries may require traders to be 20 or 21 years old.

Farther Reading

For Specific Countries

Source: https://www.daytrading.com/forex

Posted by: sherrysulty1974.blogspot.com

0 Response to "Day Trade Advice Tips Forex 4u"

Post a Comment